Cracks in the global monetary system: IMF and BRICS

Two major summits took place concurrently during the last weekend of October: the International Monetary Fund (IMF) meeting in Washington, D.C., and the BRICS summit in Kazan, Russia.

The IMF marked its 80th anniversary, having been established alongside the World Bank at the 1944 Bretton Woods conference, where the global financial system was rebuilt around the United States dollar.

The IMF serves as a lender of last resort for member countries and supports exchange-rate stability. It also provides a platform for decision-makers in the global monetary system and conducts significant economic research. The organization now has 191 members, with Liechtenstein recently joining.

Founded in 2009 as a group of major emerging economies outside of the G7, BRICS initially included Brazil, Russia, India and China, with South Africa joining in 2010. It expanded in 2023, when Iran, Ethiopia, Egypt, Saudi Arabia and the United Arab Emirates became members. In response to the perceived dominance of the Bretton Woods institutions – the World Bank and the IMF – by the U.S. and Europe, the BRICS countries formed the New Development Bank.

Global debt underemphasized

The IMF meeting featured delegations led by finance ministers and central bank heads, with participation from various organizations. Concerns included slow growth, trade fragmentation and the global debt crisis. However, discussions mainly focused on institutional remedies rather than promoting free-market mechanisms, deregulation or entrepreneurship. The global growth forecast is projected to decline to 3.1 percent by 2029, yet such forecasts frequently undergo downward revisions.

While the meeting served as a valuable forum for dialogue, especially for smaller economies, the debt issue remains underemphasized. Few governments are willing to reduce spending or address the looming timebomb of liabilities tied to pensions, healthcare and aging populations.

The blockchain alternative

In contrast, the BRICS summit appeared – on the surface at least – more vibrant, with heads of state and government attending, including India’s Prime Minister Narendra Modi, China’s President Xi Jinping, Brazil’s President Luiz Inacio Lula da Silva, South Africa’s President Cyril Ramaphosa, Turkey’s President Recep Tayyip Erdogan and United Nations Secretary-General Antonio Guterres.

The main topic was monetary policy, albeit with a different approach from the IMF meeting. The agenda included a proposal for an international payment system based on the blockchain (a type of distributed ledger technology) that would facilitate peer-to-peer transactions in the currencies of trading partners, bypassing the necessity of using any lead currency. This rather sensible system aims to improve security and efficiency in global trade. Beijing and Moscow especially, along with other emerging economies, have voiced concerns about the dollar’s dominance.

The Kazan summit had other implications. President Vladimir Putin used the event to signal that Russia is not isolated, given the presence of so many prominent leaders. Additionally, China and India pledged to seek accommodation on their border disputes in the Himalayas, though enormous challenges remain.

The choice of Kazan, a city with a majority Muslim population and the site of one of the most important Orthodox Christian churches, carries symbolic weight. The city was once the capital of the Islamic Tartar Khanate, later conquered by Tsar Ivan, and the territory included Crimea.

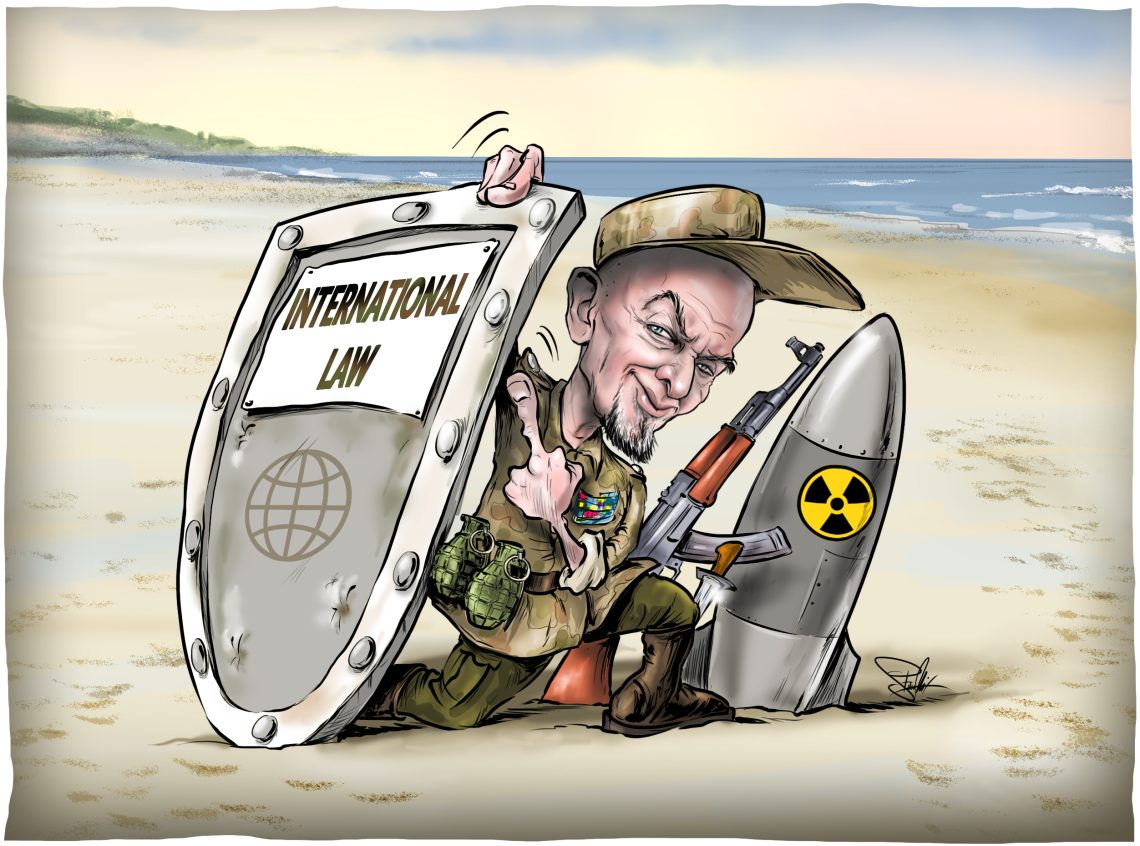

Confrontation over collaboration

The timing of the IMF and BRICS meetings may be coincidental, but they highlight the growing global fragmentation and disruptive change. While the traditional systems have their merits, they are showing cracks, demonstrating the irresponsible fiscal policies of mature economies like the U.S. and Europe. However, this trend of political expediency has become a global phenomenon.

Distributed ledger technology holds promise for increasing efficiency in international trade, but success will depend on the details and on avoiding political misuse or lack of political will.

The emerging divide between Washington and Kazan could lead to confrontation rather than fruitful collaboration, jeopardizing global trade – the foundation of progress and prosperity.

This comment was originally published here: https://www.gisreportsonline.com/r/global-monetary-system/