How would the US benefit if Argentina dollarizes?

A few weeks ago, Argentina slid into another currency crisis. In what appeared to be a desperate move, the Argentine government reached out to the U.S. Treasury, seeking assistance from its Exchange Stabilization Fund (ESF)—the same fund famously used to help Mexico during the Tequila Crisis in the mid-1990s.

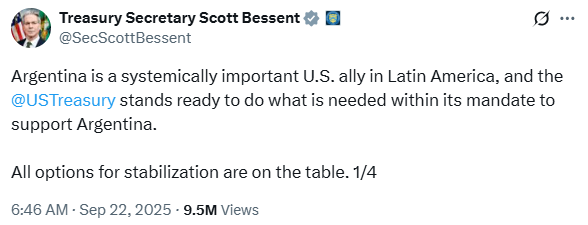

Argentina hasn’t received a single dollar yet, but it did receive extraordinary political support from President Donald Trump and U.S. Treasury Secretary Scott Bessent, who stated that “all options are on the table.”

The currency drama, coupled with U.S. Treasury involvement, brought renewed attention to President Milei’s campaign promise to dollarize the economy. Could dollarization be back on the table in exchange for U.S. support?

In this post, I want to focus on the potential benefits to the United States (not Argentina) if Argentina were to formally dollarize.

Three benefits to the US if Argentina formally dollarizes

The U.S. would benefit from Argentine dollarization in three ways. Importantly, Argentina’s decision to dollarize would impose no costs on the U.S., nor does the U.S. need to be involved if it chooses not to be.

First, increased seigniorage. Formal dollarization would increase demand for U.S. dollars. Even though Argentina is already informally dollarized, official adoption would bring additional international demand for dollars, as it would receive legal tender status.

Second, geopolitical positioning. Argentina is a large economy. Formal adoption of the U.S. dollar could help counter concerns about international de-dollarization. More importantly, it could pull Argentine politics closer to the U.S. and away from Chinese influence.

This geopolitical dimension extends beyond currency swap arrangements with China. China operates a space monitoring station in Neuquén Province that has operated since 3018 with minimal Argentine oversight (a facility U.S. officials worry could serve military purposes). Dollarization would create stronger alignment between Argentina and the U.S., potentially limiting China’s strategic expansion in South America. This geopolitical calculus is likely the real motivation behind U.S. support during Argentina’s currency crisis.

Third, improved bilateral relations. Formal dollarization might help reverse longstanding anti-U.S. sentiment in Argentina, opening new opportunities for diplomacy and collaboration between the two countries.

Most likely not, at least not publicly. It would be politically costly for the U.S. to be seen as pressuring a sovereign nation to abandon its currency in favor of the dollar. The optics wouldn’t play well with voters.

If dollarization becomes part of the conversation between Argentina and the U.S., Argentina would need to put the offer on the table first.

As far as we can tell, dollarization isn’t part of any formal discussions. Those hoping Milei will deliver on this campaign promise will have to keep waiting.

This material was originally published here: https://economicorder.substack.com/p/how-would-the-us-benefit-if-argentina.