Circumventing sanctions through innovation

Sanctions imposed by the West act as economic and political tools in international relations; they aim to pressure specific countries or regions to achieve certain geopolitical objectives. These sanctions mostly have negative implications for individual businesses and governments within the targeted economies.

They can also adversely impact businesses in the sanctioning states. Western companies must often cut longstanding business ties or forgo new opportunities with counterparts in faster-growing developing world markets subject to sanctions.

Consequently, the effects of sanctions reverberate across the global economy by restricting trade, financial and other economic activities. This significantly impacts global supply chains, international partnerships and technology exchange.

Sanctions can also have profound consequences for private and public sector policy innovation. One study on sanctions from 1988 to 2016 concluded that restrictive trade measures significantly harm innovation in countries with high levels of trade openness, globalization and democracy. In contrast, the negative effects are less pronounced in nations with lower levels in these categories.

However, contrary to the study’s findings, since Russia invaded Ukraine in February 2022 and Western countries dramatically ramped up sanctions, the situation has become considerably more complex. In the main countries targeted by sanctions, namely, Russia, China, Turkey, Hong Kong, Cyprus and the United Arab Emirates, each characterized by high levels of trade openness and globalization, the adverse effects are much less evident due to growing and extensive economic and business innovation.

Russia’s new era of digital financial innovation

Russia has faced more than 22,500 sanctions imposed by Western countries, making it the most sanctioned nation in the world. It accounts for around 61 percent of all international sanctions imposed by the United States. The second- and third-most sanctioned states, Iran and North Korea, make up 15 percent and 2 percent, respectively, of U.S. sanctions.

According to media reports, many Western consumer and business goods are still available in Russia. These have been largely made available through the Russian business sector’s circumvention of U.S. and European Union primary sanctions, including its removal from the SWIFT international payments system.

Facts & figures

Total number of sanctions imposed on Russia, Feb. 2022 to Feb. 2023

However, the threat of U.S. secondary sanctions on non-U.S. global financial institutions that authorities perceive to “significantly” facilitate trade directly or indirectly with much of Russia’s economy has had more far-reaching effects. The slowing trade growth seen in 2024, especially with its largest trading partner, China, highlights the impact of this extra-territorial policy tool.

In response to Washington’s restrictive financial measures, Russia has recently adopted a new law expanding and promoting international trade in cryptocurrencies. This innovative policy allows Russian businesses to conduct transactions without relying on G7 currencies. Given the increased acceptance of cryptocurrencies as a medium of exchange and store of value, the move also supports Russian traders’ credibility with global partners. Russia’s central bank also enabled a new digital ruble to be made available to many businesses and individuals across the country for use in the domestic market.

In the future, the digital ruble could be used for international trade, connecting with central banks of other countries and transacting cross-border digital versions of their currencies. Such an innovation could help bypass commercial banks which have been especially wary of the risk of falling under U.S. secondary sanctions.

Moscow has proposed a BRICS plan to launch a blockchain-based digital payment system linking member states through access points facilitating settlements in central bank digital currencies. The significance of this innovative development was underscored by a report in a Nasdaq publication affirming that any BRICS-developed payment and currency alternative “would likely significantly impact the U.S. dollar, potentially leading to a decline in demand, or what’s known as de-dollarization. In turn, this would have implications for the United States and global economies.” The proposed BRICS currency could empower these countries to gain economic autonomy and challenge the U.S.-dominated global financial system and its dollar. It is also a development that U.S. President-elect Donald Trump has taken seriously – threatening to impose 100 percent tariffs on BRICS countries should they launch an alternative currency challenging the dollar’s leading status.

The BRICS-based payment system was not launched in October at the group’s summit in Kazan, Russia. However, Moscow and Beijing seem to be gearing up for a significant expansion in their bilateral digital trade starting next year. This could lay the groundwork for a BRICS payments system shortly thereafter.

China’s advanced chip-making surprises the West

Between 2022 and 2023, U.S. President Joe Biden’s administration sanctioned more than 300 Chinese entities across various technology, aerospace and marine science organizations. The preceding presidency of Donald Trump had sanctioned 260 Chinese enterprises.

Furthermore, President Biden has increasingly turned to the foreign direct product rule as an export control mechanism to limit the flow of foreign products made using U.S. technology to sanctioned companies in China. This aims to constrain China’s technological advances, particularly in developing advanced microelectronics.

However, these efforts may be working to the contrary in several key technology sectors. According to a report by the Information Technology and Innovation Foundation, while China still lags behind the West in several technological areas, it is making rapid strides in semiconductors, Artificial Intelligence and electric vehicles (EVs). The report highlighted that Chinese firms are anticipated to match or surpass Western companies in certain technologies within the next decade. This forecast brings into focus the concern that China’s ability to innovate could be more advanced than envisaged.

Facts & figures

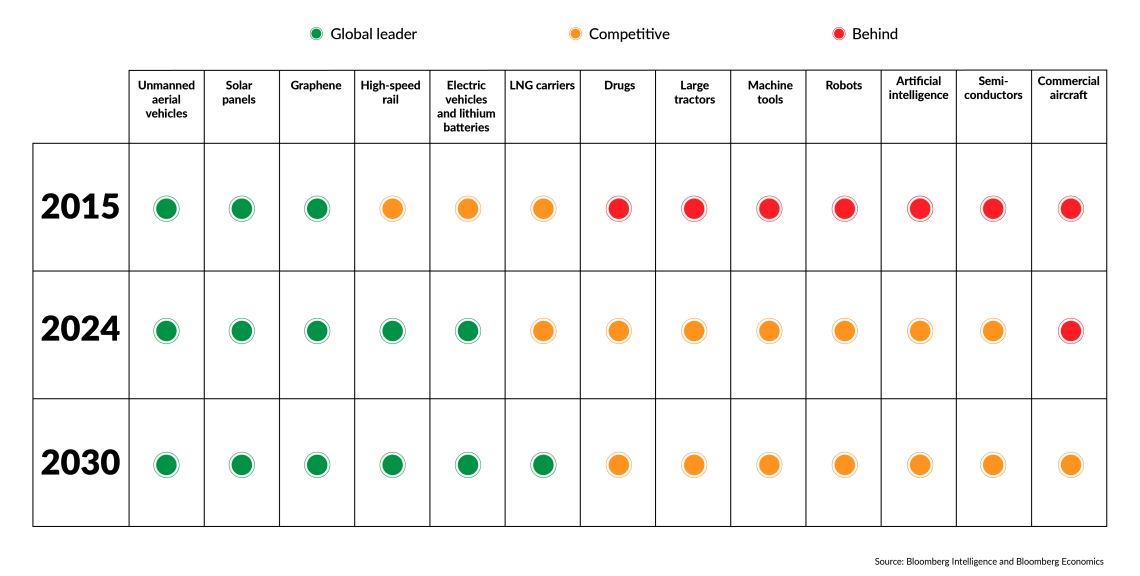

China is a global leader in five key technologies

China has emerged as a global leader in five of the 13 advanced technologies tracked by Bloomberg analysts, including high-speed rail, solar panels, EVs, lithium batteries and UAVs. Moreover, it is quickly gaining ground in seven additional sectors, such as AI, large tractors, robotics and semiconductors. © GIS

China has emerged as a global leader in five of the 13 advanced technologies tracked by Bloomberg analysts, including high-speed rail, solar panels, EVs, lithium batteries and UAVs. Moreover, it is quickly gaining ground in seven additional sectors, such as AI, large tractors, robotics and semiconductors. © GIS

While U.S. export controls have significantly raised barriers to Chinese technological development, they have also propelled China’s technology sector to work harder and innovate. As Beijing strives for technological independence and supremacy through domestic innovation, its government is channeling billions of dollars into research and development to sustain the momentum.

China’s advanced chipmaking capabilities have surprised many Western observers as companies like Huawei-owned HiSilicon and Biren Technology continue to develop increasingly competitive logic chips despite being on the U.S. sanctions list. According to Bloomberg, while the Chinese-developed chip is not top of the range, it stated that “Huawei’s smartphone business has since recovered and is now challenging Apple.”

Chinese memory chip manufacturers Yangtze Memory Technologies and ChangXin Memory Technologies have proven especially adept at managing breakthroughs in creating more advanced chips. Through ongoing investment in such technologies, China could further develop high-performance chips, undermining the impact of U.S. sanctions. The more existential threat this poses involves dislodging the U.S. from its leadership of global technology. This shift has been likened to the tech equivalent of de-dollarizing from the U.S.-led international financial system.

Turkey innovates with new defense technologies

Turkey has been subject to increasing U.S. sanctions since 2010, but the situation escalated significantly in 2020 when Ankara opted to purchase the Russian S-400 air defense system. While the sanctions targeted key executives of its main weapons manufacturer, new export controls prohibited sales of the F-35 fighter jets to Turkey. Washington has also sanctioned several Turkish individuals and companies for violating sanctions against Moscow, including for transferring civilian and military dual-use goods to Russia.

In response, the Turkish defense industry was compelled to innovate and develop homegrown defense technologies. The country’s defense industry has now become an important international player and innovator in the production of weaponry, primarily focused on export sales. In 2022, Ankara’s weapons exports amounted to around $400 million, a significant increase from only $20 million in 2000. This growth propelled it to become the world’s 11th largest exporter of defense equipment.

Turkey’s reputation was particularly boosted in this sector when, in 2018, Qatar, Ankara’s closest ally in the Gulf, ordered Bayraktar TB2 drones from Baykar, a Turkish defense company. A major order from Ukraine followed. The soaring demand for Turkish unmanned aerial vehicles (UAVs) has made the country one of the world’s leading exporters of this type of product. By the end of last year, Baykar had exported UAVs to over 30 countries.

Unlike its allies in NATO, Ankara does not perceive Moscow or Beijing as significant threats to its military or political interests. This policy differential has enabled Turkey to collaborate innovatively with rivals of the West in defense and aerospace while staying within Western blocs.

Scenarios

Highly likely: Sanctions-driven innovation to challenge the West

Even in the face of combined export controls by the Trump and Biden administrations targeting more than 500 Chinese entities, Goldman Sachs has estimated that China could lift its chip self-sufficiency to 40 percent of its overall semiconductor usage by 2030 – nearly double the current levels.

A recent Bloomberg article highlights the challenges Washington is facing in its attempts to impose export controls designed to restrict China’s access to advanced technologies, particularly in chip manufacturing. Despite these attempts to elbow China out of international technology supply chains, Bloomberg analysts highlighted that Beijing has established global leadership in five of the 13 most advanced technologies they are tracking. These include high-speed rail, solar panels, EVs, lithium batteries, graphene and UAVs. Moreover, China is quickly catching up in seven other sectors such as Artificial Intelligence, large tractors, robots and semiconductors.

This also attests to a growing international acceptance of Chinese technological supremacy. It points out the increasing worldwide demand for key products such as its EVs, the almost ubiquitous global reliance on its solar panels for energy consumption and the growing dependence on Chinese mobile devices for internet access and communication.

The result of all this may be the exact opposite of what Washington’s sanctions aim to achieve. There is a real risk that the U.S. could become isolated as China continues to advance in international technology leadership, which could have negative ramifications for its ongoing global financial and corporate dominance.

Equally likely: Regulatory barriers stifle innovation in sanctioned regimes

While sanctions and export controls are primarily designed to affect the supply-side dynamics of a targeted jurisdiction, other emerging regulatory barriers are crafted to stifle an economy’s demand-side benefits. This may have a more pernicious effect on a sanctioned economy’s innovation prospects.

The EU’s imposition of 35 percent tariffs, on top of the existing 10 percent duty, can be viewed as a penalty for the Chinese EV industry’s public-private sector collaborative innovation, albeit couched as unfair government subsidies by European authorities.

It is important to note that anti-subsidy probes are usually initiated by complaints from European industries. However, the inquiry into the latest tariffs on China was launched at the European Commission’s discretion without backing from industry bodies. Beijing has recently filed a case with the World Trade Organization challenging the EU’s tariffs. A ruling in favor of China would uphold its innovative public-private model.

Earlier this year, the Biden administration imposed blanket tariffs on a wide range of Chinese goods, including a 100 percent levy on EVs. Canada imposed similar tariffs on Chinese EVs and added extra duties on its aluminum and steel exports.

Looking to the future, new research by the Grantham Research Institute on Climate Change and the Environment at the London School of Economics and Political Science has found that tariffs proposed by U.S. President-elect Donald Trump could reduce China’s gross domestic product (GDP) by 0.68 percent. Mr. Trump has repeatedly warned of his plans to impose a universal 20 percent import tariff on all foreign-made goods, a 100 percent tariff on all car imports (although this would mainly target Chinese vehicles beyond EVs) and a 60 percent tariff on all Chinese imports. Mr. Trump has even threatened a 200 percent tariff on some imported vehicles, plus other punitive tariff measures on companies, sectors and countries in a fast-moving policy environment.

The loss of a significant export market such as the U.S. through the imposition of tariffs will undoubtedly hit already-sanctioned economies hard. In such a trade-restrictive environment, no amount of innovation will necessarily compensate for the losses, especially if it triggers a damaging trade war.

Yet the last word on how innovation is stifled often lies in the effect of sanctions. Where sanctions are especially broad in scope, their effect on the economic activity of a targeted jurisdiction may become especially pronounced. This recently happened in Russia when the U.S. sanctioned Gazprombank, the country’s last major bank not subject to restrictive measures, along with 49 smaller Russian banks. The result was a sharp fall in the ruble to record lows, aside from the brief and immediate decline right after Ukraine’s invasion in 2022. This culmination of sanctions across Russia’s entire financial sector may have seriously dampened the outlook for foreign capital inflows, potentially stunting the Kremlin’s ability to innovate through growth.

Thic report was originally published here: https://www.gisreportsonline.com/r/international-sanctions/